RealEstate professionals are increasingly turning to artificial intelligence to enhance their decision-making processes and forecast market trends effectively. By harnessing AI technologies, you can analyze vast amounts of data, identify patterns, and gain valuable insights that can guide your investment strategies. In this blog post, you’ll uncover practical methods to integrate AI into your real estate practice, empowering you to stay ahead of market shifts and make informed choices. Let’s explore how to leverage these powerful tools to optimize your real estate endeavors.

Understanding AI in Real Estate

While the adoption of Artificial Intelligence (AI) continues to reshape various industries, its influence on the real estate sector is becoming increasingly significant. As you explore how to use AI in Real Estate to revolutionize the Industry?, it’s vital to comprehend how AI operates within this field. From predictive analytics to automated property valuations, AI provides insights that can enhance your decision-making processes, enabling you to stay ahead of market dynamics.

Understanding AI’s capabilities allows you to leverage data-driven strategies that reflect shifting market conditions. By utilizing algorithms that analyze an array of factors, including historical trends, economic indicators, and neighborhood characteristics, AI can provide valuable forecasts that can guide your investment choices and business operations. The growing reliance on AI in real estate illustrates the need for you to adapt and integrate these technologies into your practices for sustained success.

How AI Analyzes Market Trends

Real estate professionals are increasingly turning to AI to analyze market trends effectively. Through machine learning algorithms, AI systems sift through vast amounts of real estate data, recognizing patterns and predicting future shifts in the market. By employing techniques such as regression analysis and time-series forecasting, AI can assist you in making informed predictions regarding property valuations and market health, thereby improving your strategic planning.

Furthermore, AI takes into account various data sources, including demographic trends, economic conditions, and even social media buzz to generate a holistic view of market sentiments. By implementing these advanced analytics, you can identify emerging opportunities and potential risks, which can be pivotal in an industry where timing and location are everything.

Key Algorithms Used in Real Estate Predictions

Real estate predictions often rely on various key algorithms to interpret complex datasets. Among these, methods like neural networks, decision trees, and support vector machines are commonly utilized. These algorithms are designed to evaluate historical data, identify correlations among various influencing factors, and ultimately generate predictive outcomes. (Choosing the right algorithm can significantly impact the accuracy of your predictions and the success of your investments.)

Moreover, the effectiveness of these algorithms largely depends on the quality and relevance of data fed into them. The more comprehensive the dataset, the more reliable the predictive models become. (Hence, ensuring data integrity should be a priority in your AI strategy.)

This makes it imperative for you to not only understand which algorithms best suit your needs but also how to continuously refine the data you utilize for predictions. By focusing on quality over quantity in data collection and analysis, you can harness the true potential of AI in real estate to revolutionize your operations and maximize your profits.

Tips for Implementing AI in Your Real Estate Business

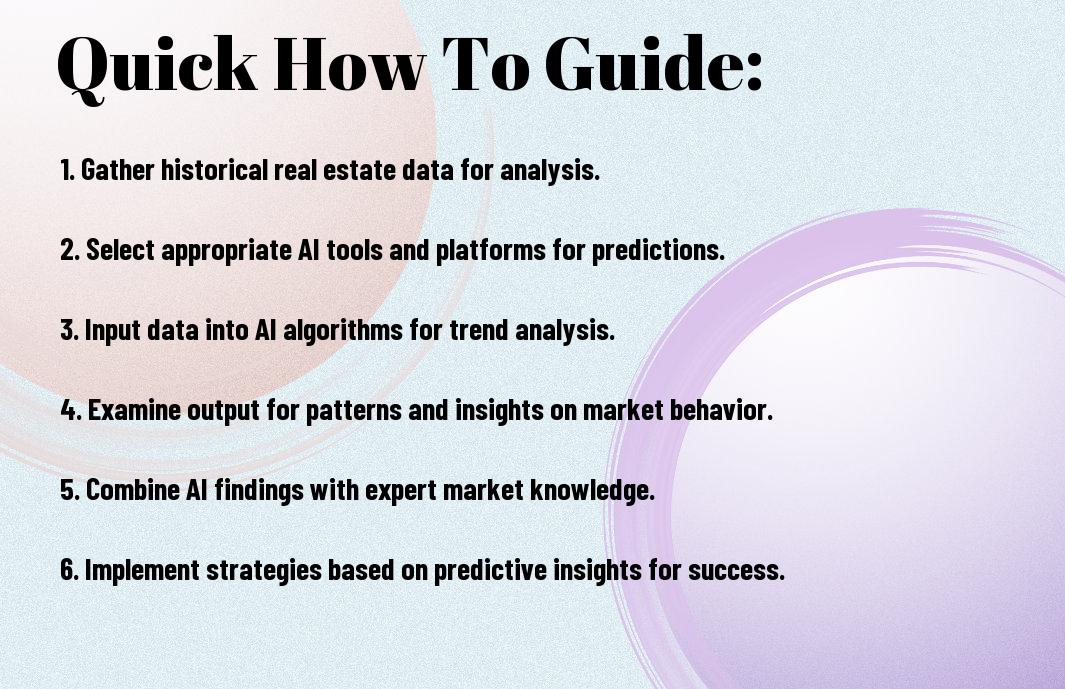

Some strategies can help you successfully implement AI in your real estate business. Start by identifying specific needs and objectives that you want AI to address. Next, ensure that you have a skilled team to lead the implementation process. Here are some tips to consider:

- Evaluate your current data infrastructure.

- Research available AI tools tailored to real estate.

- Consider partnerships with technology providers.

- Train your staff on AI functionalities and benefits.

- Monitor performance and iterate based on feedback.

This approach will enable you to harness The power of generative AI in real estate and adapt to market changes effectively.

Choosing the Right Tools and Technologies

The selection of AI tools and technologies can shape the effectiveness of your real estate strategies (choosing tools that integrate seamlessly with your existing workflows is imperative). Start by assessing your organization’s objectives and the types of analyses you wish to perform. Popular options include predictive analytics for market trends, chatbots for customer inquiries, and virtual property tours. Consider conducting a pilot program for a few tools to gauge their impact and user experience before making a significant investment.

Integrating AI with Existing Systems

Real estate professionals often face challenges when integrating AI into their existing systems (having a strategic plan can smooth this transition). Begin by identifying the platforms you currently use for transaction management, customer relationship management (CRM), and property listings. Ensure that your AI solutions can communicate and exchange data with these systems seamlessly. This integration will not only enhance efficiency but also provide richer insights and analytics.

Plus, regular audits and updates of your systems will help maintain compatibility as technology evolves. Conducting routine evaluations can also aid in identifying gaps in your data flow, leading you to better utilization of AI’s capabilities. Ultimately, a thoughtful integration process will maximize your investment in AI and lead to improved outcomes for your business.

Factors Influencing Market Predictions

All successful real estate investments hinge on understanding the factors that influence market predictions. In the age of artificial intelligence, leveraging various data points can significantly enhance your forecasting abilities. Here are some of the key elements you should consider:

- Economic indicators like employment rates and GDP growth

- Local real estate supply and demand dynamics

- Interest rates and their impact on mortgage affordability

- Consumer confidence levels and spending habits

- Government regulations and policy changes

Perceiving these variables can provide you with invaluable insights into potential market shifts.

Economic Indicators and Data Analysis

Market predictions in real estate fundamentally rely on economic indicators and robust data analysis. Key metrics such as employment rates, inflation, and Gross Domestic Product (GDP) offer a window into the overall health of the economy. By integrating these indicators into your predictive models, you can better anticipate the direction of the real estate market. For instance, an increase in employment usually correlates with higher housing demand, while a dip in GDP may suggest a downturn.

Additionally, examining localized economic conditions is imperative. Analyzing data specific to a particular area, such as job growth in a tech sector or infrastructure developments, can greatly impact your investment strategies. Access to AI-driven analytics tools enables you to dissect vast amounts of data quickly, leading to well-informed predictions that inform your decisions.

Social Trends and Demographic Insights

To successfully forecast real estate trends, understanding social trends and demographic insights is vital. These trends illuminate shifts in consumer behavior, which can dictate housing demand in various regions. For instance, an increasing number of millennials entering the housing market might influence the types of properties that are in demand, such as smaller homes or those located near urban centers. (Recognizing these shifts ensures you’re investing in areas likely to thrive.)

Trends such as urbanization, aging populations, and lifestyle preferences constantly evolve. Staying attuned to these demographics enables you to make strategic decisions that align with market trajectories. For example, locales that attract young professionals or families can signal the potential for sustainable growth and higher property values. (Identifying the demographics influencing your target market will guide you towards informed investment ventures.)

How to Train AI Models for Accurate Predictions

Not all AI models are created equal; their effectiveness largely depends on the quality of the data used to train them. To predict market trends accurately in real estate, you must start with comprehensive data collection and preparation. This involves gathering relevant data points, such as historical property prices, economic indicators, demographic information, and local market trends. Once you have amassed this data, it’s imperative to clean and preprocess it by addressing missing values and removing outliers. A clean dataset ensures that your AI model can learn from reliable inputs, ultimately leading to better predictive outcomes.

Data Collection and Preparation

Accurate data collection and preparation lay the foundation for successful AI training. You should focus on obtaining diverse data sources to ensure that your model captures various market dynamics. For instance, exploring public records, real estate listings, and online property marketplaces will provide you with a well-rounded dataset. After gathering this information, dividing it into training, validation, and test sets is necessary to evaluate the model’s performance effectively. This structured approach enables your AI to generalize its predictions beyond the data it was trained on.

Fine-tuning Models for Desired Outcomes

An imperative aspect of training AI models involves fine-tuning them to achieve your desired outcomes. This can be accomplished by adjusting hyperparameters, selecting relevant features, and using techniques like cross-validation to improve the model’s accuracy. It’s important to iterate on these adjustments based on the performance feedback you receive during testing and validation (deciding on how much effort to invest in these iterations will greatly impact your model’s effectiveness). Fine-tuning is not a one-time effort; it requires continuous monitoring and refinement as market dynamics change over time.

Collection of feedback from real estate transactions and market behaviors will also inform your tuning process. You should analyze how well your model predicts actual outcomes and use those insights to refine its parameters further. A successful fine-tuning process balances complexity and interpretability, ensuring your model can adapt while providing clear insights into market trends (making a strategic plan for regular updates will maximize your model’s longevity and reliability).

Real-World Applications of AI in Real Estate

After shedding light on the potential of AI in transforming the real estate landscape, it’s important to probe into tangible applications that can enhance your decision-making processes. One of the most impactful aspects is the ability to harness AI for predictive analytics, enabling you to anticipate shifts in the market. By analyzing a wealth of historical data and current trends, AI algorithms can identify patterns and provide forecasts, helping you to strategize effectively in both buying and selling properties. This data-driven approach can empower you to make informed choices, minimizing risks and optimizing returns on your investments.

Market Analysis and Strategy Development

On venturing into market analysis, it’s evident that AI has revolutionized the way real estate professionals evaluate property values and market dynamics. By leveraging machine learning models, you can examine comprehensive datasets, including socio-economic indicators, neighborhood demographics, and historical sales data. This fosters a nuanced understanding of market conditions, enabling you to develop strategies that align with emerging trends. For instance, if AI identifies a surge in demand for rental properties in a particular area, you can pivot your investment focus to capitalize on this opportunity swiftly.

Risk Assessment and Investment Decision Making

Market volatility is an ever-present factor in real estate, but with AI tools at your disposal, you can navigate your investment decisions with greater confidence. By analyzing risk factors associated with specific properties or markets, AI helps you to understand potential pitfalls and forecast challenges, allowing you to mitigate those risks proactively. This not only aids in evaluating existing investments but also in discerning the best opportunities for new acquisitions.

The use of AI in risk assessment goes beyond surface-level analysis; it encompasses advanced predictive modeling that evaluates various scenarios based on market fluctuations and external economic factors. With this insight, you can make strategic decisions that align with your risk tolerance and investment objectives, ensuring that you are well-prepared for any market shifts. By integrating AI tools into your investment strategy, you enhance your ability to thrive in the competitive real estate arena.

Keeping Up with Evolving AI Technologies

Despite the rapid advancements in artificial intelligence, staying updated in the real estate sector requires dedicated effort. AI technologies are constantly evolving, and new tools and algorithms emerge regularly that can significantly enhance your ability to predict market trends. You must be proactive in identifying which innovations best suit your needs and implementing them in your strategies. By continuously monitoring developments in AI, you position yourself to leverage these advancements effectively, ensuring that you remain competitive in the ever-changing real estate landscape.

Continuous Learning and Adaptation

Learning is an ongoing process that is imperative for your success in utilizing AI in real estate. Engaging with resources such as webinars, online courses, and industry conferences can help you uncover new insights into advanced AI applications. Additionally, reading relevant articles and publications can deepen your understanding of how AI continues to shape market predictions and trends. This commitment to learning ensures that you can adapt your strategies to incorporate the latest AI tools, resulting in more accurate forecasting for your business.

Networking and Collaborating with Experts

Some of the most valuable insights can come from networking and collaborating with experts in AI and real estate. Building relationships with industry professionals enables you to share knowledge and best practices, while also keeping you informed about new developments in the field. When you discuss challenges and solutions with peers or mentors, you enhance your understanding and expand your toolkit for leveraging AI effectively. (Establishing such connections can also open doors to potential partnerships for AI projects.)

It is imperative to engage with a diverse network, as this will expose you to varying perspectives and innovative approaches in AI applications. Joining forums and attending meetups focused on real estate and AI can facilitate these connections. Actively seeking collaboration with data scientists, technologists, or AI developers can offer your real estate strategies a much-needed edge. (By prioritizing networking, you position yourself to unlock new opportunities and insights that can transform your approach to market forecasting.)

Conclusion

Now that you have explored the imperative insights on using AI in real estate to predict market trends, you can leverage this technology to enhance your investment strategies and decision-making processes. By harnessing data analysis, machine learning algorithms, and predictive analytics, you can gain a better understanding of market behaviors, property values, and future demands within your market. This knowledge equips you to make informed decisions that can ultimately lead to increased profitability and reduced risk in your real estate endeavors.

As you integrate AI tools into your operations, you should continuously test and refine your strategies based on the insights gained. Embrace a data-driven mindset, and remain attentive to emerging trends and technologies that can further optimize your real estate practices. By doing so, you position yourself ahead of the curve, ready to seize new opportunities and navigate the dynamic landscape of the real estate market with confidence.

FAQ

Q: What are the main advantages of using AI in real estate market trend predictions?

A: Utilizing AI in real estate offers several benefits, including enhanced accuracy in forecasting market trends, the ability to analyze large datasets quickly, and the capability to identify patterns that may not be apparent through traditional analysis. AI algorithms can process historical sales data, economic indicators, and demographic information to predict future property values and trends. This helps investors and agents make informed decisions and allocate resources more effectively.

Q: How can real estate professionals implement AI tools to improve their services?

A: Real estate professionals can harness AI tools by incorporating predictive analytics software into their operations. These tools can analyze data from various sources, such as listings, social media trends, and economic reports, to provide insights about pricing strategies and neighborhood desirability. Additionally, professionals can utilize AI-powered chatbots to enhance customer engagement, streamline inquiries, and provide personalized property recommendations based on user preferences.

Q: What types of data should be collected for effective AI analysis in real estate?

A: For AI analysis to be effective in predicting market trends in real estate, a diverse range of data should be collected. This includes historical property sale prices, rental rates, regional economic indicators, demographic information, and market supply and demand metrics. Additionally, integrating data from social media and online reviews can provide insights into consumer sentiment and preferences. The quality and comprehensiveness of the data collected directly influence the accuracy of the predictions generated by AI models.

Comments