Most real estate professionals are beginning to recognize the transformative power of AI in effectively valuing properties. By leveraging artificial intelligence, you can analyze vast datasets, uncover market trends, and make more informed pricing decisions. In this guide, you’ll discover actionable strategies to integrate AI tools into your valuation processes, enabling you to enhance accuracy and efficiency while staying competitive in the ever-evolving real estate landscape.

Understanding AI in Real Estate

For those in the real estate industry, understanding how AI can transform property valuation is necessary for staying competitive. AI technology leverages vast amounts of data to analyze patterns and trends that human appraisers would find challenging to discern in a timely manner. By incorporating machine learning algorithms and predictive analytics, AI tools can deliver precise valuations based on various factors, such as location, market trends, and property characteristics. Doing so not only enhances the accuracy of the valuation but can also streamline the entire process, providing you with quick and actionable insights to inform your investment decisions (as accurate valuations influence sale prices).

How AI Works in Property Valuation

While traditional property valuation methods often rely on a single appraiser’s intuition and experience, AI enhances this process by utilizing large datasets and machine learning techniques. These systems can effectively evaluate historical sales data, current market conditions, and even prospective buyer behavior to generate a comprehensive property valuation. Through these advanced algorithms, AI can provide real-time updates and adapt to shifts in the market, ensuring that valuations are consistently relevant and reliable.

Key AI Technologies Used in Real Estate

While AI in real estate encompasses various technologies, some key components include machine learning, natural language processing, and computer vision. Machine learning, for instance, enables systems to learn from patterns within data over time, enhancing their predictive capabilities regarding property prices. Natural language processing can analyze property descriptions and customer reviews to derive sentiment and potential value insights, while computer vision can be employed to evaluate property features through image analysis. By integrating these technologies, real estate professionals can achieve a well-rounded view of property values and trends.

This innovative approach allows you to harness the power of AI to facilitate smarter, data-driven decisions. By adopting these technologies, you can optimize the valuation process and significantly improve your market analysis. In turn, this will enhance your ability to identify investment opportunities and complete property transactions swiftly and effectively.

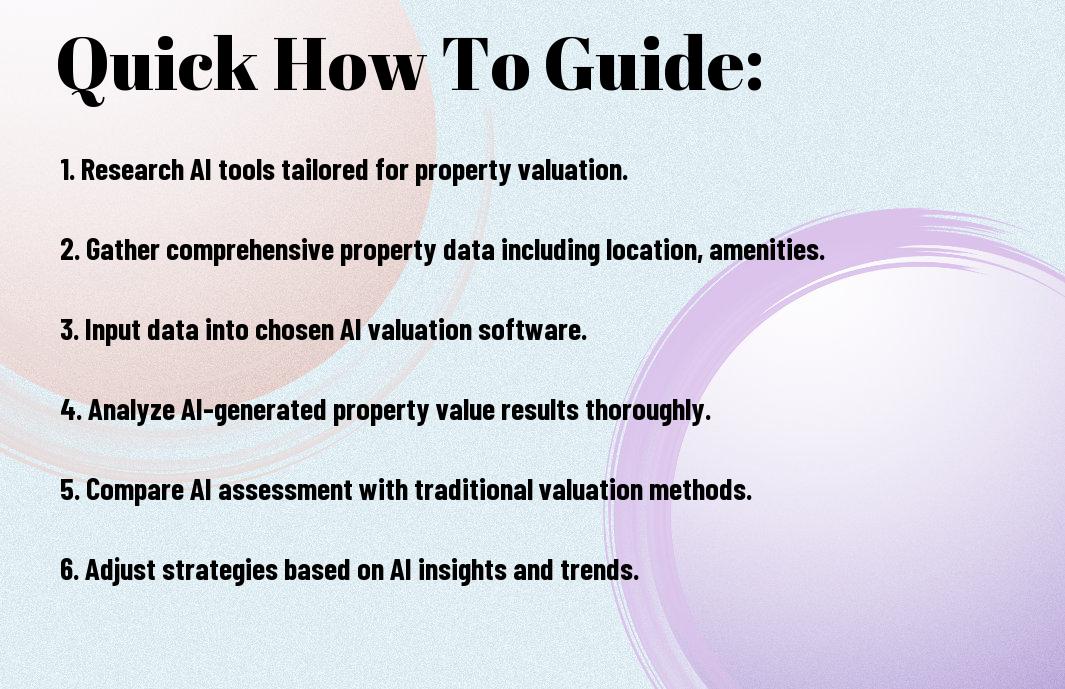

How to Leverage AI for Effective Property Valuation

Implementing AI Tools and Software

One of the most efficient ways to enhance your property valuation process is by implementing advanced AI tools and software. These technologies can analyze a multitude of data points, such as recent comparable sales, market trends, neighborhood demographics, and even zoning regulations. By leveraging these tools, you can obtain a more accurate valuation of properties and make informed decisions about pricing strategies and investment opportunities. (Choosing the right software can significantly influence the quality of your valuations.)

Some popular AI platforms in real estate include automated valuation models (AVMs) which utilize machine learning algorithms to predict property values. These systems continuously learn from new data, allowing you to stay ahead in a dynamic market. Integrating these technologies into your valuation process can lead to quicker assessments, freeing you up to focus on other critical aspects of your business.

Integrating AI with Traditional Valuation Methods

Implementing AI does not mean you have to abandon traditional valuation methods; instead, you can find a harmonious balance between the two. Mixing quantitative AI analytics with qualitative approaches, such as neighborhood assessments and condition evaluations, provides a more well-rounded and reliable property valuation. This integration can help identify market nuances that AI alone might overlook, resulting in a comprehensive understanding of true property value.

Valuation becomes a powerful process when combining the strengths of AI with traditional methods. By utilizing AI’s ability to process large amounts of data rapidly alongside your local market expertise, you position yourself to deliver highly accurate and credible valuations. This combination not only builds trust with your clients but also strengthens your competitive edge in the real estate market.

Essential Tips for Accurate Property Valuation Using AI

Many real estate professionals are leveraging AI to enhance the accuracy of property valuations. By understanding and applying a few crucial tips, you can ensure that your valuations are data-driven and reliable. Here are some strategies to consider:

- Utilize multiple data sources to gather comprehensive market insights.

- Incorporate historical sales data alongside current market trends.

- Adjust for unique property features that may impact value.

- Regularly update your AI models with new market information.

Perceiving the importance of high-quality data and continuous learning will set you apart in a competitive market.

Data Collection Strategies

One effective way to optimize your property valuations is by focusing on data collection strategies. This involves sourcing both quantitative and qualitative data, including property characteristics, neighborhood demographics, and economic factors. Additionally, consider integrating alternative data sources like social media sentiment and local economic indicators to enrich your analysis. (Deciding to invest time in detailed research can greatly improve your valuation accuracy.)

Continuous Learning and Adaptation

Assuming the real estate market is ever-changing, ongoing education is vital. You should regularly train your AI models to adapt to new trends and shifts in buyer behavior, ensuring that your valuations remain relevant. It’s also beneficial to engage with industry experts, attend webinars, and review current research to stay informed. (Choosing to prioritize continuous learning can lead to more accurate property assessments in the long run.)

For instance, by frequently updating your algorithms with the latest data and market conditions, you not only maintain the effectiveness of your AI tools but also enhance their predictive capabilities. When you actively adapt to market demands, you’re better positioned to provide accurate valuations. (Taking the initiative to incorporate an adaptive approach in your workflow is integral to success in real estate.)

Factors Influencing AI-driven Property Valuation

Keep in mind that several factors play a significant role in determining property value when it comes to AI-driven evaluations. Utilizing algorithms, AI can analyze vast amounts of data to help you identify trends and anomalies that may affect market prices. Some of the influential factors include:

- Location and neighborhood demographics.

- Economic indicators and unemployment rates.

- Historical property sales data.

- Market supply and demand conditions.

- Regulatory changes and their impacts.

After considering these factors, you can better understand how AI models produce accurate property valuations tailored to your specific market conditions.

Market Trends and Dynamics

If you are keen on leveraging AI for property valuation, it’s vital to analyze current market trends and dynamics that inform the real estate landscape. AI leverages historical market data alongside real-time analytics to identify underlying trends that may impact property values. Factors like average days on market, price fluctuations, and the health of the local economy are continuously monitored, allowing you to make informed predictions about future property value movements.

Property Features and Condition

There’s no denying that the physical attributes of a property significantly influence its valuation. While AI can efficiently process data related to location and market conditions, it also examines individual property features such as square footage, number of bedrooms and bathrooms, and unique selling points like swimming pools or energy-efficient appliances. Additionally, the overall condition of the property, including any recent renovations, repairs, or necessary maintenance, can sway valuations upward or downward.

Valuation algorithms consider these property-specific elements, applying weight to each feature based on their correlation with market behaviors. By incorporating such details, AI models generate a more nuanced and accurate property evaluation, enabling you to ascertain a property’s true worth in today’s competitive market. With insights into both market trends and individual property characteristics, you’ll be well-equipped to make strategic decisions when buying or selling real estate.

Common Pitfalls to Avoid with AI in Real Estate

Overreliance on Technology

All too often, real estate professionals may find themselves overly dependent on AI tools for property valuation, which can lead to overlooking critical market factors. To effectively utilize AI, it’s crucial that you maintain a balanced approach, ensuring that technology complements your insights rather than entirely replacing them. (Properly integrating AI into your processes can enhance your decision-making capabilities.)

Ignoring Human Expertise and Insight

The power of AI cannot overshadow the importance of human expertise in real estate valuation. You may have access to the most advanced algorithms, but if you disregard the insights seasoned professionals can provide, you risk missing key nuances in property assessments. This includes understanding specific market trends, local nuances, and buyer psychology that AI, despite its strength in processing data, may not fully capture. (Incorporating qualitative insights from human experts can greatly enhance your property valuation accuracy.)

It is vital to recognize that while AI can aggregate vast amounts of data and analyze patterns, it lacks the ability to understand the subtleties of human behavior and local market dynamics. You should actively seek input from real estate agents, appraisers, and other stakeholders who possess valuable experience in your specific market. (Creating a symbiotic relationship between AI technology and human insight will lead to more informed valuation outcomes.)

Future Trends in AI and Property Valuation

Once again, the integration of AI in property valuation is set to evolve dramatically as emerging technologies pave the way for more sophisticated methodologies. As data analytics continues to mature, you can expect to see machine learning algorithms becoming more adept at identifying properties that match your investment criteria. This sophistication will not only enhance accuracy but also streamline your decision-making processes, allowing you to focus on strategic growth rather than tedious analyses.

Moreover, the use of AI-driven predictive analytics is likely to gain momentum, enabling you to anticipate market trends and property values more effectively. By leveraging vast data sets that include historical sales, economic indicators, and social media sentiment, you are positioned to make informed decisions that align with market demands.

Emerging Technologies and Innovations

Innovations in AI technology are rapidly transforming how property valuation is approached. You will find that advancements in natural language processing allow for improved interaction with real estate platforms, as chatbots and virtual assistants can guide you through valuation queries in real-time. Additionally, the rise of IoT devices and smart home technologies can provide rich data streams that help AI systems better assess property value based on real-time usage and environmental factors.

As these technologies continue to evolve, they will not only enhance the understanding of property valuations but can also drive deeper insights into consumer preferences, allowing you to tailor your investments to meet changing market landscapes. The dynamic nature of these innovations offers you new avenues for exploration and investment potential.

The Evolving Role of AI in the Real Estate Market

Evolving your understanding of AI’s role in the real estate market is important as it begins to serve more than just a valuation tool. The implementation of AI can assist you in conducting due diligence by verifying real estate documents and expediting the transactional process, making it easier for you to close deals efficiently. (Consider implementing AI tools early in the valuation process to maximize their benefits.)

For instance, AI algorithms can analyze nearby market trends, zoning laws, and neighborhood demographics to give you a clearer picture of property dynamics. This helps you assess potential risks and rewards associated with an investment. Embracing AI not only enhances your valuation accuracy but also equips you with predictive insights that can significantly inform your investment strategies. (Investing in AI-driven applications will likely become indispensable for those committed to staying competitive in the real estate landscape.)

Conclusion

Considering all points, integrating AI into your property valuation processes can significantly enhance the accuracy and efficiency of your real estate decisions. By leveraging advanced algorithms and data analytics, you can better analyze market trends, assess property values, and ultimately make informed investment choices. Utilizing AI tools allows you not only to streamline your workflow but also to stay ahead of the competition in a rapidly evolving industry.

To fully harness the capabilities of AI for property valuation, you should continuously seek out resources and tools that can provide comprehensive insights. A great starting point is The Complete Guide to AI in Real Estate, which can equip you with the knowledge needed to effectively implement these technologies in your strategy. By doing so, you empower yourself to make data-driven decisions that enhance your real estate endeavors and maximize your investments.

Q: How can AI enhance the accuracy of property valuations in real estate?

A: AI enhances the accuracy of property valuations by analyzing vast amounts of data that human appraisers might overlook. It utilizes machine learning algorithms to evaluate historical sales data, local market trends, property features, and economic indicators. By integrating these complex datasets, AI provides a more precise valuation based on current market conditions. Additionally, AI can adjust valuations in real-time as new data becomes available, ensuring that property values reflect the most current information.

Q: What types of AI tools are available for real estate professionals focused on property valuation?

A: There are several AI-powered tools available for real estate professionals, including automated valuation models (AVMs), predictive analytics platforms, and sentiment analysis tools. AVMs use algorithms to estimate property values based on comparable sales and market trends. Predictive analytics can forecast future property values by analyzing various market factors, such as neighborhood growth and economic changes. Sentiment analysis tools help gauge buyer and seller sentiments from online reviews and social media, providing insights that can affect property valuation.

Q: Are there any limitations or challenges when using AI for property valuation?

A: Yes, while AI offers many advantages, there are limitations and challenges to consider. One major challenge is data quality; if the data input is inaccurate or incomplete, the AI’s output may lead to incorrect valuations. Additionally, AI models can sometimes lack transparency, making it difficult for real estate professionals to understand how the valuation was derived. Lastly, market fluctuations and unique property characteristics may not always be adequately accounted for by AI, necessitating the expertise of experienced appraisers to interpret and refine the AI-generated valuations.

Comments